Consumer spend on video in Asia was a “tale of two cities”, Media Partners Asia (MPA) executive director Vivek Couto said in his opening presentation at the APOS 2021 online event this morning.

While pay-TV revenue would drop to 30% of consumer spend in Australia in 2025 and to 18% in Thailand, the sector was expected to command 80% in India despite rapid growth in spend on online video.

In China, pay-TV’s share of subscription spend was slowly eroding but would still be 55% in 2025, driven by strong IPTV, while in the Philippines, online video subscription was expected to overtake pay-TV subscriptions by 2025.

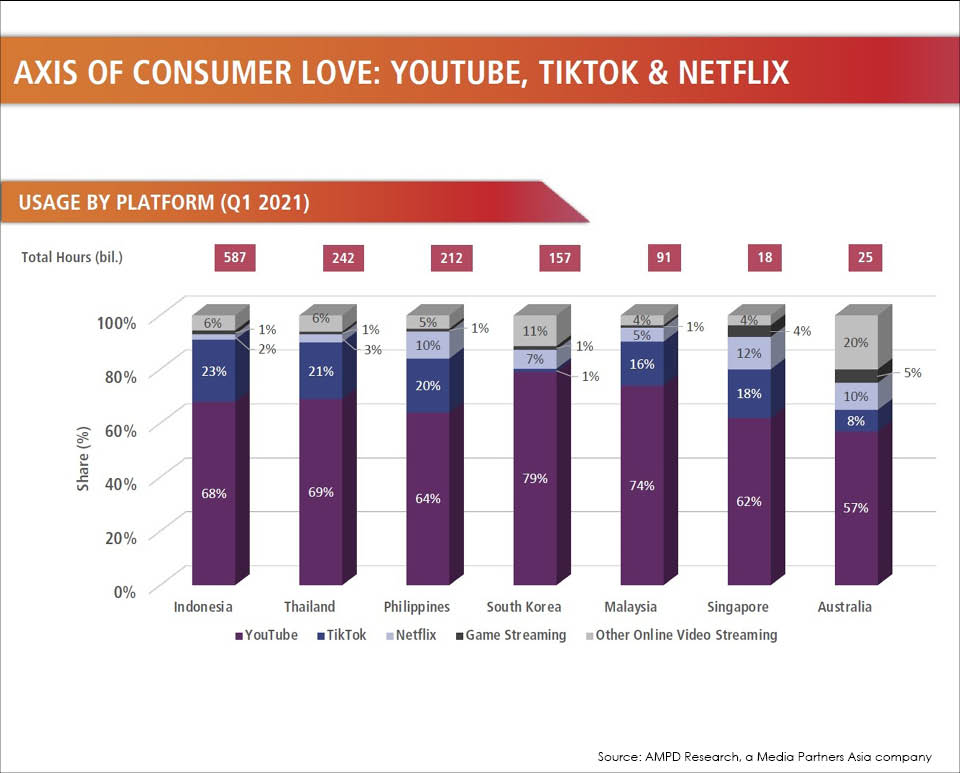

In his trademark state-of-the-industry address to open the annual show, Couto also described an “axis of consumer love” between YouTube, Tiktok and Netflix in the region, and said online streaming was “massive”.

YouTube dominates with shares ranging from 64% to 83% of content streamed.

Tik-Tok was second, with 8%-16% of total time streamed, excluding Korea where the service has yet to take off.

Couto said Netflix was the third largest streamer in many markets, although it lagged in Indonesia and Thailand because of competition from local and regional platforms.

Other OTT platforms are of increasing importance. These include local platforms such as Vidio (Indonesia) and Line (Thailand) as well as Hong Kong’s Viu and Chinese platforms, WeTV and iQIYI.

In the first quarter of this year, Indonesia was the largest streaming market with almost 600 billion hours consumed.

Singapore was the smallest with 18 billion hours, but the heaviest user of video on a per capita basis.

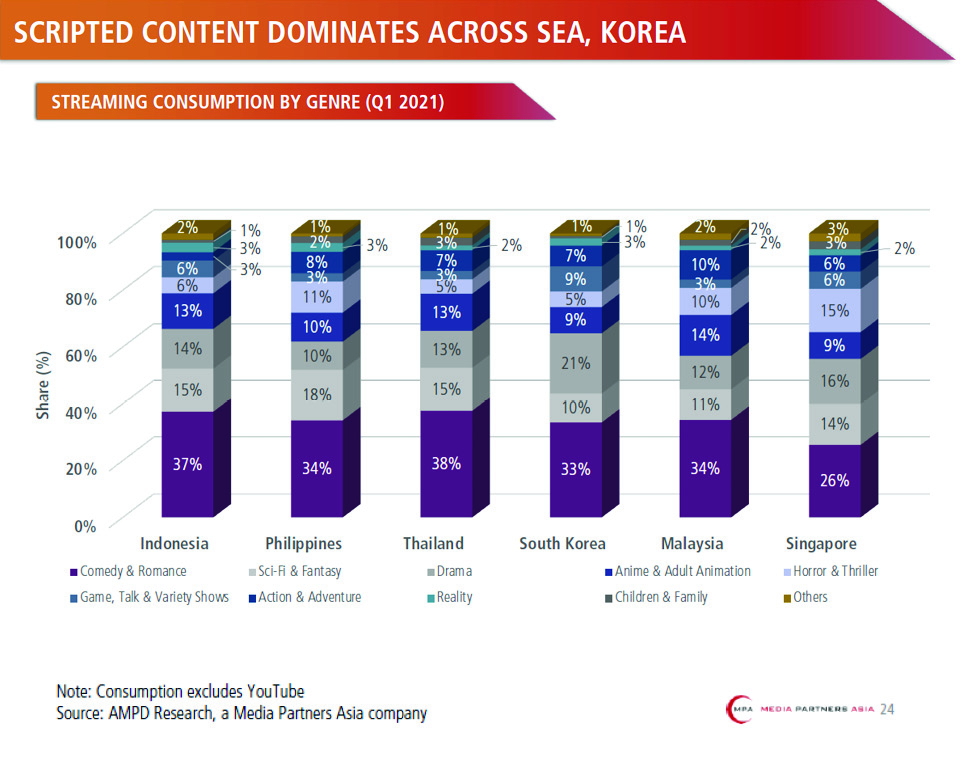

Across the region, Korean, North American and Japanese content typically drove at least 75% of consumption, Couto added.

"Thailand is the exception where Line and others are establishing a strong presence with local language content," he said, adding that as mainland Chinese streamers iQiyi and WeTV expanded, consumption of Chinese video was growing.

"Local content consumption will rise in markets with local champions such as Vidio in Indonesia and potentially iWant /TFC in the Phillipines," he said.

MPA also found that series were more popular than movies, usually capturing 80% plus of video consumed. Movies generally account for 10-20% of hours watched.

Content investments by OTT platforms continued to soar, Cout...

Consumer spend on video in Asia was a “tale of two cities”, Media Partners Asia (MPA) executive director Vivek Couto said in his opening presentation at the APOS 2021 online event this morning.

While pay-TV revenue would drop to 30% of consumer spend in Australia in 2025 and to 18% in Thailand, the sector was expected to command 80% in India despite rapid growth in spend on online video.

In China, pay-TV’s share of subscription spend was slowly eroding but would still be 55% in 2025, driven by strong IPTV, while in the Philippines, online video subscription was expected to overtake pay-TV subscriptions by 2025.

In his trademark state-of-the-industry address to open the annual show, Couto also described an “axis of consumer love” between YouTube, Tiktok and Netflix in the region, and said online streaming was “massive”.

YouTube dominates with shares ranging from 64% to 83% of content streamed.

Tik-Tok was second, with 8%-16% of total time streamed, excluding Korea where the service has yet to take off.

Couto said Netflix was the third largest streamer in many markets, although it lagged in Indonesia and Thailand because of competition from local and regional platforms.

Other OTT platforms are of increasing importance. These include local platforms such as Vidio (Indonesia) and Line (Thailand) as well as Hong Kong’s Viu and Chinese platforms, WeTV and iQIYI.

In the first quarter of this year, Indonesia was the largest streaming market with almost 600 billion hours consumed.

Singapore was the smallest with 18 billion hours, but the heaviest user of video on a per capita basis.

Across the region, Korean, North American and Japanese content typically drove at least 75% of consumption, Couto added.

"Thailand is the exception where Line and others are establishing a strong presence with local language content," he said, adding that as mainland Chinese streamers iQiyi and WeTV expanded, consumption of Chinese video was growing.

"Local content consumption will rise in markets with local champions such as Vidio in Indonesia and potentially iWant /TFC in the Phillipines," he said.

MPA also found that series were more popular than movies, usually capturing 80% plus of video consumed. Movies generally account for 10-20% of hours watched.

Content investments by OTT platforms continued to soar, Couto said.

In India, "OTT companies in 2020 invested more than US$700 million on content and this is expected to rise by another 30% in 2021. Moreover, a lot of this growth is coming from commissioning and acquisition of local content – a trend which picked by meaningfully in 2019," he added.

About 30% of this content spend is on originals.

"Going forward local original content will account for more than 40-45% of content spends as platforms up their ante on rolling more titles at higher budgets," Couto said.