Malaysian media platform Astro says its transformation plans are yielding results, and last night drew attention to gains in arpu, advertising and broadband for the third quarter of its financial year to end January 2024.

“Our strategic plans to transform Astro into a digital, streaming company are yielding results,” Astro group CEO, Euan Smith, said, adding that adjacent businesses – Astro Fibre and sooka – were both “on a positive growth trajectory this year despite the headwinds”.

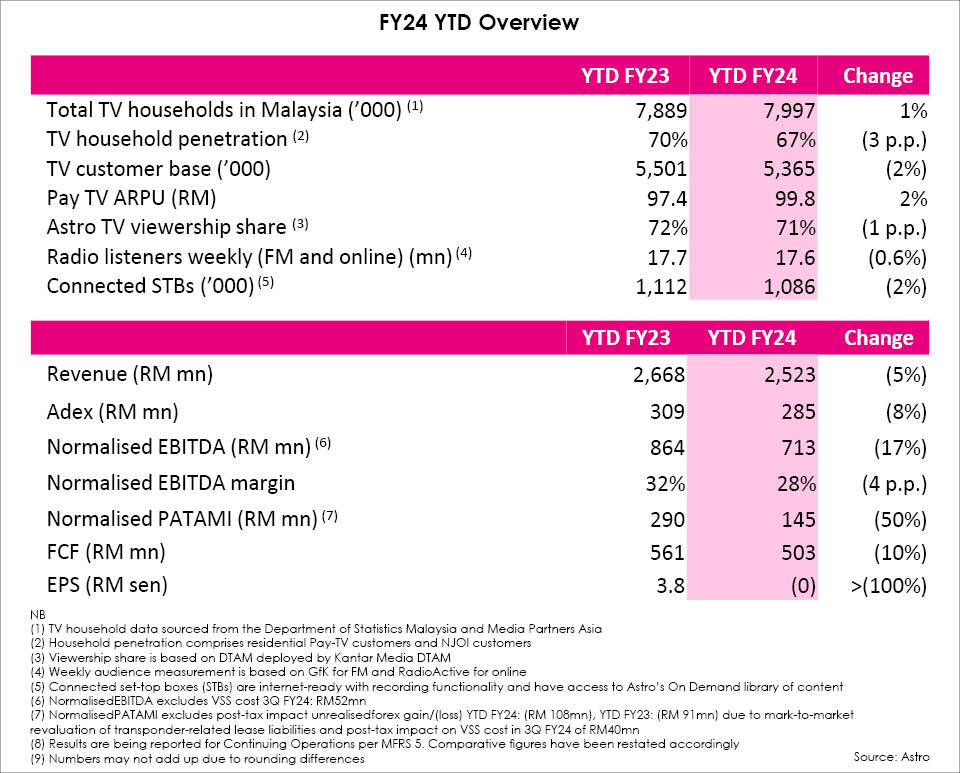

Those headwinds make for dismal financials this year so far.

Overall revenue for the quarter dropped 6% to RM 828.5 million/US$177.4 million.

Gross profit was down 18% to RM 227.6 million/US$48.7 million.

Profit from operations for the quarter was down 60% to RM 52.3 million/US$11.2 million.

After tax losses from continuing operations for the quarter were RM 41.1 million/US$8.8 million compared to RM 5.1 million/US$1.1 million profit in the same quarter last year.

Core TV subs revenue for the nine months to end October was RM 2,387.5 million/US$511.25 million, down from RM 2,528.6 million/US$541.44 million in the same period the previous year.

TV segment losses (before tax) for the nine months were RM 45.7 million/US$9.78 million compared to profit (before tax) of RM 211.4 million/US$45.27 million the previous year.

The latest financials exclude the recent Voluntary Separation Scheme (VSS) costs of RM 52 million/US$11 million and unrealised forex losses on transponder lease liabilities. The VSS reduced headcount by 20%.

Arpu was up RM 99.80/US$21.35 – an increase of RM 2.40/US$0.51 year-on-year, driven by new TV packs and broadband bundles. This is the fourth consecutive quarter Astro has registered arpu increases.

Astro’s broadband base rose 22% year on year.

sooka monthly active users (MAU) rose over 80% quarter on quarter to 1.5 million monthly active users, 84% of which are on mobile.

sooka subs grew 50% driven by an expanded content library, including live sports and children’s shows and 15 FAST cha...

Malaysian media platform Astro says its transformation plans are yielding results, and last night drew attention to gains in arpu, advertising and broadband for the third quarter of its financial year to end January 2024.

“Our strategic plans to transform Astro into a digital, streaming company are yielding results,” Astro group CEO, Euan Smith, said, adding that adjacent businesses – Astro Fibre and sooka – were both “on a positive growth trajectory this year despite the headwinds”.

Those headwinds make for dismal financials this year so far.

Overall revenue for the quarter dropped 6% to RM 828.5 million/US$177.4 million.

Gross profit was down 18% to RM 227.6 million/US$48.7 million.

Profit from operations for the quarter was down 60% to RM 52.3 million/US$11.2 million.

After tax losses from continuing operations for the quarter were RM 41.1 million/US$8.8 million compared to RM 5.1 million/US$1.1 million profit in the same quarter last year.

Core TV subs revenue for the nine months to end October was RM 2,387.5 million/US$511.25 million, down from RM 2,528.6 million/US$541.44 million in the same period the previous year.

TV segment losses (before tax) for the nine months were RM 45.7 million/US$9.78 million compared to profit (before tax) of RM 211.4 million/US$45.27 million the previous year.

The latest financials exclude the recent Voluntary Separation Scheme (VSS) costs of RM 52 million/US$11 million and unrealised forex losses on transponder lease liabilities. The VSS reduced headcount by 20%.

Arpu was up RM 99.80/US$21.35 – an increase of RM 2.40/US$0.51 year-on-year, driven by new TV packs and broadband bundles. This is the fourth consecutive quarter Astro has registered arpu increases.

Astro’s broadband base rose 22% year on year.

sooka monthly active users (MAU) rose over 80% quarter on quarter to 1.5 million monthly active users, 84% of which are on mobile.

sooka subs grew 50% driven by an expanded content library, including live sports and children’s shows and 15 FAST channels, a new pricing model and enhanced targeted marketing.

On-demand titles streamed were up 25% year on year.

Astro Go reported 545,000 monthly active users with a weekly viewing time of 3.4 hours.