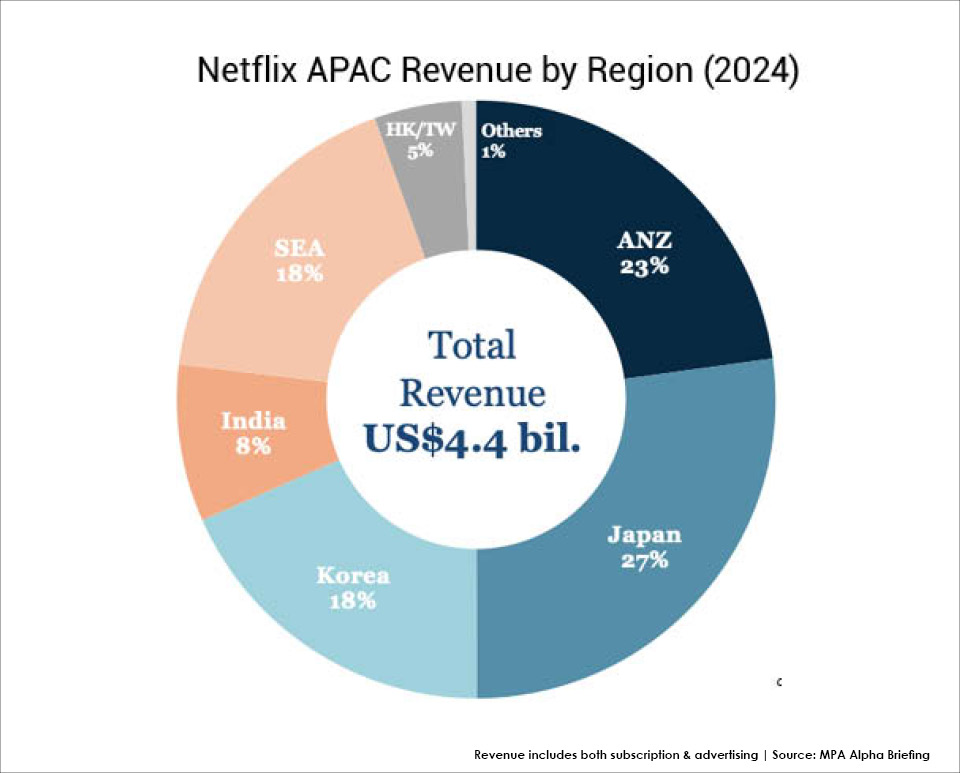

Netflix’s strong Q4 and FY2024 performance was propelled by impressive growth in the Asia Pacific region, which contributed 30% to net new subscriber growth and 12% to revenue growth (20% in Q4), Media Partners Asia (MPA) said in its latest insights briefing.

MPA said Japan remained vital with Netflix at more than 11 million subscribers and more than US$1.2 billion in revenue, while India demonstrated strong monetisation, contributing 17% to revenue growth with over 15 million subscribers.

“The impact of local programming remains significant, driving significant customer acquisition and engagement,” the briefing said.

In Q4, local content dominated in Korea and Japan. India saw similar success with local programming powering 65% of new acquisitions and over 40% of engagement. Korean content resonated strongly in Southeast Asia and Taiwan, while local content shone brightly in Indonesia, Taiwan and Thailand, MPA said, highlighting Squid Game season two’s “stellar engagement” across key APAC markets.

MPA projects substantial video industry growth in the Asia Pacific region, with US$16.2 billion in incremental revenue between 2024 and 2029 across 14 markets. This growth is driven by online video (+US$24.1 billion), led by UGC/social video.

At the same time, traditional TV is expected to contract by US$8 billion, according to the 2025 Asia Video & Broadband Dynamics.

Six key markets – India (26%), China (23%), Japan (15%), Australia (11%), Korea (9%) and Indonesia (5%) – will account for approximately 90% of incremental video industry revenue growth.

The fastest-growing segments in terms of incremental new dollars over the next five years will be UGC/social video (US$10.7 billion), SVOD (US$8.4 billion), and premium AVOD (US$5.0 billion). UGC/social video platforms, led by YouTube (ex-China), Meta, ByteDance and others in China, will remain dominant, increasingly leveraging AI to drive growth.

While subscription revenue will contribute 35% to online video’s growth, advertising will remain dominant, contributing 65%. In 2024, advertising ...

Netflix’s strong Q4 and FY2024 performance was propelled by impressive growth in the Asia Pacific region, which contributed 30% to net new subscriber growth and 12% to revenue growth (20% in Q4), Media Partners Asia (MPA) said in its latest insights briefing.

MPA said Japan remained vital with Netflix at more than 11 million subscribers and more than US$1.2 billion in revenue, while India demonstrated strong monetisation, contributing 17% to revenue growth with over 15 million subscribers.

“The impact of local programming remains significant, driving significant customer acquisition and engagement,” the briefing said.

In Q4, local content dominated in Korea and Japan. India saw similar success with local programming powering 65% of new acquisitions and over 40% of engagement. Korean content resonated strongly in Southeast Asia and Taiwan, while local content shone brightly in Indonesia, Taiwan and Thailand, MPA said, highlighting Squid Game season two’s “stellar engagement” across key APAC markets.

MPA projects substantial video industry growth in the Asia Pacific region, with US$16.2 billion in incremental revenue between 2024 and 2029 across 14 markets. This growth is driven by online video (+US$24.1 billion), led by UGC/social video.

At the same time, traditional TV is expected to contract by US$8 billion, according to the 2025 Asia Video & Broadband Dynamics.

Six key markets – India (26%), China (23%), Japan (15%), Australia (11%), Korea (9%) and Indonesia (5%) – will account for approximately 90% of incremental video industry revenue growth.

The fastest-growing segments in terms of incremental new dollars over the next five years will be UGC/social video (US$10.7 billion), SVOD (US$8.4 billion), and premium AVOD (US$5.0 billion). UGC/social video platforms, led by YouTube (ex-China), Meta, ByteDance and others in China, will remain dominant, increasingly leveraging AI to drive growth.

While subscription revenue will contribute 35% to online video’s growth, advertising will remain dominant, contributing 65%. In 2024, advertising accounted for 52% of total APAC video revenue; this is projected to increase to 54% by 2029, fueled by the expansion of premium AVOD.

MPA also said connectivity would fuel growth.

“Active connected TV (CTV) penetration is rapidly increasing, boosting big-screen engagement and monetisation,” the latest briefing said.

By 2029, active CTV penetration will reach 85-90% in Australia, Korea and Japan and 25-50% in India, Indonesia, and Thailand. Fixed broadband growth (excluding China) is projected at a 4.2% CAGR (2024-2029), driven by fibre deployments in key markets.

The SVOD subscription surge, which “significantly accelerated in 2024”, was driven by India, China, Japan, Thailand, Indonesia, Korea and Australia.

SVOD subscriptions are projected to grow from 644 million in 2024 to 870 million by 2029 (APAC ex-China: 296 million to 505 million, an 11.3% CAGR). This growth is supported by new low-cost ad tiers, expanding sports offerings, and the growth of local content marketplaces and new formats.

MPA pointed out shifting power dynamics in the region’s video industry.

The Big 6 (YouTube, Netflix, Meta, Disney, Amazon Prime Video and TikTok) held a 67% share of the online video revenue market (ex-China) in 2024.

“This share is projected to decline to 62% by 2029 as local players gain prominence in India, Indonesia, Japan, Korea, and Thailand,” MPA said.

YouTube consistently ranked among the top two video industry monetisers (streaming and TV) across four of the six largest markets in 2024. However, local players led in India, Indonesia, and Korea, MPA said.

“In premium VOD, Netflix led in all markets except India (JioCinema), although local competition is strong in Indonesia, Japan, Korea, and Thailand. Four of the top 10 largest VOD platforms by streaming revenue in Asia Pacific during 2024 originated from China,” the briefing added.