SCHEDULE WATCH: Regional movie channel, Celestial Movies (CM), turned 20 this year, closing out two decades of delivering Chinese blockbusters in Malaysia, Singapore and Indonesia.

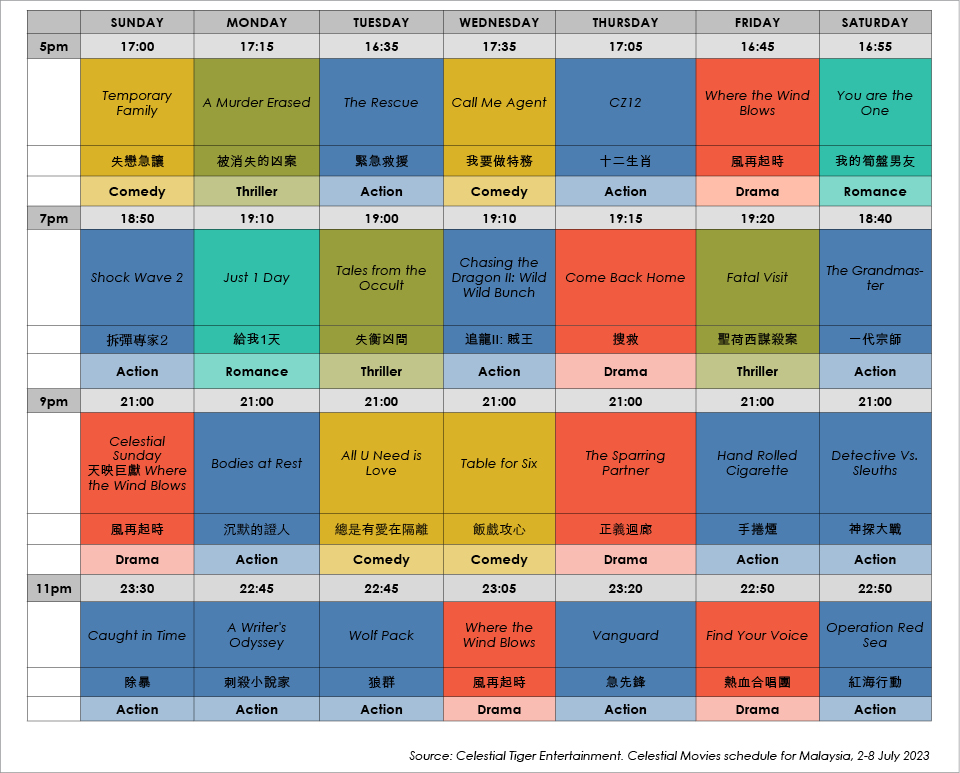

Across the three markets, each of which has a customised feed, new titles include Philip Yung’s crime drama, "Where the Wind Blows", starring Aaron Kwok and Tony Leung (2 July, Malaysia) and Hong Kong comedy, "Table for Six" (5 July, Malaysia).

July premieres also include 41st Hong Kong Film Award winner, "The Sparring Partner", which is Hong Kong’s highest-growing Cat III film; and "Detective Vs Sleuths", China’s highest-grossing Hong Kong film last year.

CM’s milestone moment coincides with the final exit of primary rival, the 29-year-old Star Chinese Movies, from the market in a slow-death regional fade that ends this December in Taiwan.

Whatever rights benefits flow from Disney’s exit, CM’s core priority – command of the Chinese movie space – remains firm, focused and unchanged.

If anything has changed, it is the rise in Chinese movie quality and production values, CTE says, pointing out that some of China’s CGI, for instance, is now on a par with Hollywood.

“With this continuous improvement in quality, the box office contribution for Chinese movies has also been increasing year on year,” the network says.

CM updates implemented by Hong Kong-based owner/operator, Celestial Tiger Entertainment (CTE), involve tech to maintain relevance in the digital space and the adjustment of rights to accommodate new platforms.

“We invest a lot in content and our acquisitions strategy has always been to own the first and exclusive movie space with the biggest stars, the biggest blockbusters,” says CTE CEO, Ofanny Choi.

“So long as we have great content and carefully curated programmes, alongside offering other ancillary rights like catch-up and on demand to complete their viewing experience, our audience stays,” Choi adds.

Scheduling the linear service involve...

SCHEDULE WATCH: Regional movie channel, Celestial Movies (CM), turned 20 this year, closing out two decades of delivering Chinese blockbusters in Malaysia, Singapore and Indonesia.

Across the three markets, each of which has a customised feed, new titles include Philip Yung’s crime drama, "Where the Wind Blows", starring Aaron Kwok and Tony Leung (2 July, Malaysia) and Hong Kong comedy, "Table for Six" (5 July, Malaysia).

July premieres also include 41st Hong Kong Film Award winner, "The Sparring Partner", which is Hong Kong’s highest-growing Cat III film; and "Detective Vs Sleuths", China’s highest-grossing Hong Kong film last year.

CM’s milestone moment coincides with the final exit of primary rival, the 29-year-old Star Chinese Movies, from the market in a slow-death regional fade that ends this December in Taiwan.

Whatever rights benefits flow from Disney’s exit, CM’s core priority – command of the Chinese movie space – remains firm, focused and unchanged.

If anything has changed, it is the rise in Chinese movie quality and production values, CTE says, pointing out that some of China’s CGI, for instance, is now on a par with Hollywood.

“With this continuous improvement in quality, the box office contribution for Chinese movies has also been increasing year on year,” the network says.

CM updates implemented by Hong Kong-based owner/operator, Celestial Tiger Entertainment (CTE), involve tech to maintain relevance in the digital space and the adjustment of rights to accommodate new platforms.

“We invest a lot in content and our acquisitions strategy has always been to own the first and exclusive movie space with the biggest stars, the biggest blockbusters,” says CTE CEO, Ofanny Choi.

“So long as we have great content and carefully curated programmes, alongside offering other ancillary rights like catch-up and on demand to complete their viewing experience, our audience stays,” Choi adds.

Scheduling the linear service involves traditional considerations – including marathons, special stunts, and counterprogramming against competing channels.

Catch-up/on-demand access has been added to this to offer an all-inclusive experience. “As such, catch-up rights and in fact on demand rights, are pre-requisites for all our content acquisitions,” CTE says.