Asia’s content creators and storytellers “have to be aware of content bubbles” in the new video ecosystem, Media Partners Asia (MPA) executive director, Vivek Couto, said during the opening of the APOS September edition this morning.

Outlining key trends and influences in a 40-minute state of the industry presentation, Couto said advertising had deteriorated and that streaming/OTT content licensing in the near to medium term was not enough to offset the loss.

This would “hurt content creators”; “the online window isn’t really going to fill the void and that’s a big risk,” he said.

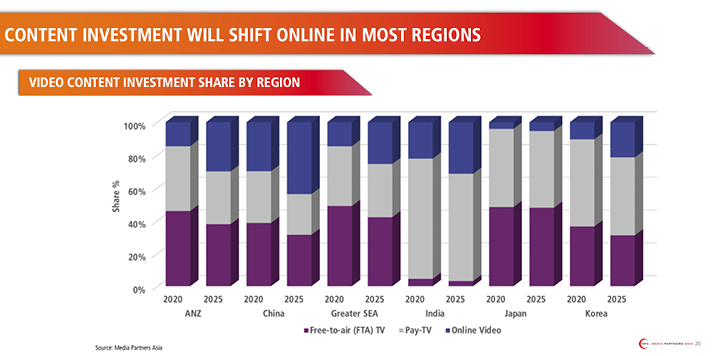

He also warned that while streaming platforms would increase investment in content, “they will increasingly do so in a more balanced and sustainable mode in the new world”.

Sports rights holders “have to be prepared to accept even more serious ground realities than ever before as they look at monetising in this part of the world,” Couto said.

“Due to Covid, operators have lost their premium sports subscribers and may never regain them,” he added.

MPA revised its projections to estimate a negative 18% impact of Covid on sports revenue generation overall over the next five years. Couto said that “a further reduction in sports rights costs may be necessary across the region in order to sustain the lifeblood of fans/consumers who pay for content”.

MPA did not put its usual dollar amount on content investment in Asia Pacific in the presentation because of widespread uncertainty and “lots of swaying on sports rights”.

Couto identified the “next content battleground” as local series, where local TV players had a competitive advantage. This was already happening in India, and increasingly in Southeast Asia.

“But we expect global and regional streaming players to go into this market,” he said.

Revenues for leading APAC players are expected to contract by an average 11% in 2020.

“Most markets are stressed” this year, Couto said. Greater Southeast Asia is forecast to be 24% dow...

Asia’s content creators and storytellers “have to be aware of content bubbles” in the new video ecosystem, Media Partners Asia (MPA) executive director, Vivek Couto, said during the opening of the APOS September edition this morning.

Outlining key trends and influences in a 40-minute state of the industry presentation, Couto said advertising had deteriorated and that streaming/OTT content licensing in the near to medium term was not enough to offset the loss.

This would “hurt content creators”; “the online window isn’t really going to fill the void and that’s a big risk,” he said.

He also warned that while streaming platforms would increase investment in content, “they will increasingly do so in a more balanced and sustainable mode in the new world”.

Sports rights holders “have to be prepared to accept even more serious ground realities than ever before as they look at monetising in this part of the world,” Couto said.

“Due to Covid, operators have lost their premium sports subscribers and may never regain them,” he added.

MPA revised its projections to estimate a negative 18% impact of Covid on sports revenue generation overall over the next five years. Couto said that “a further reduction in sports rights costs may be necessary across the region in order to sustain the lifeblood of fans/consumers who pay for content”.

MPA did not put its usual dollar amount on content investment in Asia Pacific in the presentation because of widespread uncertainty and “lots of swaying on sports rights”.

Couto identified the “next content battleground” as local series, where local TV players had a competitive advantage. This was already happening in India, and increasingly in Southeast Asia.

“But we expect global and regional streaming players to go into this market,” he said.

Revenues for leading APAC players are expected to contract by an average 11% in 2020.

“Most markets are stressed” this year, Couto said. Greater Southeast Asia is forecast to be 24% down this year.

Streamers – particularly Viu and Netflix – fared well in the first half of this year. Couto said Viu grew 45% in the first half of the year and that Netflix was on course for its best growth year ever in Asia Pacific, with full-year revenue growth of more than 55%.

MPA’s AMPD Research shows that average weekly streaming minutes reached 5.1 billion in four markets – Philippines, Thailand, Indonesia and Singapore – during lockdown, dropping to 4.3 billion average a week post lockdown.