Content costs in Asia Pacific are “a little out of control” and will have to be “more measured in the next five years”, Media Partners Asia (MPA) executive director and co-founder, Vivek Couto, said in his state-of-the-industry address during the opening of APOS 2023 in Bali this morning.

“Local and Asian content drive the streaming economy, but costs are clearly out of control,” Couto told a packed room of 500+ people gathered in APOS’ traditional home in Bali for the first time since the pandemic.

“As online video penetrates deeper, per unit content costs needs to be rationalised and subsidised with ads,” Couto said, adding that content aggregation and smart service bundles would be critical to drive subscriber growth.

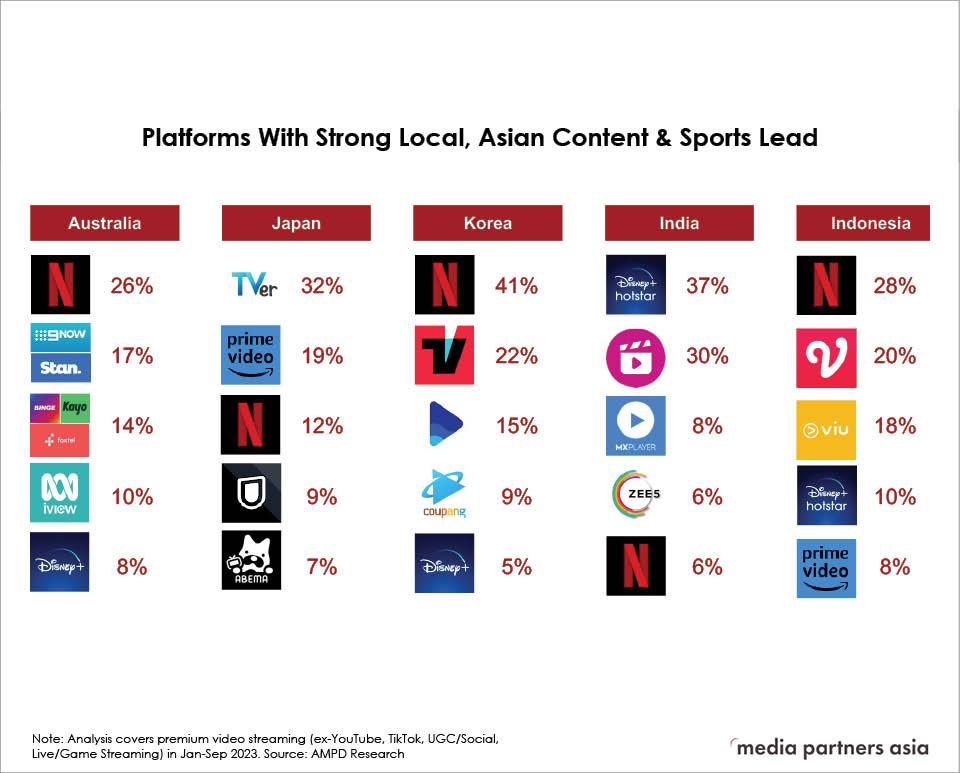

From January to August this year, local and Asian content drove 79% of premium VOD viewership in Korea from Jan-Aug 2023, dropping to 68% in Japan and 48% in India. In Indonesia, local content drove 15% of viewership in the same period.

MPA expects content investments in India to double over the next five years, primarily driven by sports, following US$11 billion of concluded sports rights over the last 18 months. Sports is projected to constitute 30% of content investment in India by 2028.

Couto highlighted the region’s overwhelming engagement with services such as YouTube and Tiktok.

Paid premium video on demand users in parts of Asia spend up to 90% of their screentime on other services, he said.

Premium VOD attracts 7% of paying subscribers’ share of screentime in Japan, rising to 8% in Indonesia and 10% in India, MPA data shows.

Five players currently control the premium VOD market (SVOD/premium AVOD revenues).

Netflix leads in Korea with 48% share of the country’s US$1.7 billion premium VOD revenue and Indonesia, where the global streamer has a 25% share of 2023’s US$0.5 billion.

Prime Video leads in Japan with 17% of share of premium VOD revenues this year.

Disney Hotstar commands 22% of India’s US$1.7 billion premium VOD revenues.

MPA expects APAC video industry revenue, excluding China, to increase to US$92 billion ...

Content costs in Asia Pacific are “a little out of control” and will have to be “more measured in the next five years”, Media Partners Asia (MPA) executive director and co-founder, Vivek Couto, said in his state-of-the-industry address during the opening of APOS 2023 in Bali this morning.

“Local and Asian content drive the streaming economy, but costs are clearly out of control,” Couto told a packed room of 500+ people gathered in APOS’ traditional home in Bali for the first time since the pandemic.

“As online video penetrates deeper, per unit content costs needs to be rationalised and subsidised with ads,” Couto said, adding that content aggregation and smart service bundles would be critical to drive subscriber growth.

From January to August this year, local and Asian content drove 79% of premium VOD viewership in Korea from Jan-Aug 2023, dropping to 68% in Japan and 48% in India. In Indonesia, local content drove 15% of viewership in the same period.

MPA expects content investments in India to double over the next five years, primarily driven by sports, following US$11 billion of concluded sports rights over the last 18 months. Sports is projected to constitute 30% of content investment in India by 2028.

Couto highlighted the region’s overwhelming engagement with services such as YouTube and Tiktok.

Paid premium video on demand users in parts of Asia spend up to 90% of their screentime on other services, he said.

Premium VOD attracts 7% of paying subscribers’ share of screentime in Japan, rising to 8% in Indonesia and 10% in India, MPA data shows.

Five players currently control the premium VOD market (SVOD/premium AVOD revenues).

Netflix leads in Korea with 48% share of the country’s US$1.7 billion premium VOD revenue and Indonesia, where the global streamer has a 25% share of 2023’s US$0.5 billion.

Prime Video leads in Japan with 17% of share of premium VOD revenues this year.

Disney Hotstar commands 22% of India’s US$1.7 billion premium VOD revenues.

MPA expects APAC video industry revenue, excluding China, to increase to US$92 billion by 2028, up from US$62 billion in 2023. Online revenue’s percentage will increase 8.8% (CAGR), while TV will drop 1.1%.

The revenue split between television and online video has shifted from 84%/16% five years ago to a 65%/35% split today, Couto said.

Over the next five years, TV will dip below US$50 billion and online video will rise to US$43 billion – a 53%/47% split – with online video segments overtaking television revenue in Indonesia, Thailand and Taiwan.

Philippines and Vietnam are the fastest growing online video markets in Southeast Asia, while India will be the fastest growing overall at 14%.

“If we look at growth over the next five years in Southeast Asia, Indonesia will account for more than a third of the revenue”, while TV in Korea would still be “a shade larger than online,” Couto said.

Premium AVOD and UGC/social video will drive new revenues, led by India at 3.3%, and followed by Japan, Korea and Southeast Asia, where net incremental video revenue growth over the next five years is forecast to be 2.4%.

Couto said pay-TV was “yet to be meaningfully disrupted in key markets”, and that as subscription growth slowed, advertising and price increases were “key for the future” in Japan, while in Indonesia “price increases and rationalisation will drive sustainability”.

Pay-TV disruption varies across the region, from India, “where disruption won’t occur in probaby five years”, to Indonesia, where “there wasn’t really a pay-TV market to begin with”, and where online video players are growing the premium category from scratch, Couto said.

Couto described this as “challenging but they are succeeding slowly”.