StarHub CEO, Tan Tong Hai, hurtles towards the end of his career at the Singapore telco with (clearly) undiminished enthusiasm for the company’s prospects after the door shuts behind him.

StarHub CEO, Tan Tong Hai, hurtles towards the end of his career at the Singapore telco with (clearly) undiminished enthusiasm for the company’s prospects after the door shuts behind him.

Just before the Lunar New Year weekend, less than three months before his exit on 1 May this year, Tan invested a little more than S$500,000/US$394,000 in company shares, which had dropped to six-month lows mid-Feb.

Tan notified the Singapore Stock Exchange on 15 Feb that he was buying 200,000 ordinary voting shares at S$2.59 per share, giving him a total of 754,854 shares – or a 0.04% stake in the company.

The disclosure came a day after the Valentine’s Day release of the company’s financials, which saw StarHub’s 2017 net profit slide by 27% to S$249.6 million/US$190 million.

In his comments on the results, Tan talked about “taking our customer-centric approach a step further by adopting a higher level of artificial intelligence to anticipate our customers’ needs” in 2018.

2018 “will also usher in changes to the competitive landscape and we are ready to seize opportunities offered by the market,” he added.

Enterprise fixed revenue (more specifically cyber security solutions and managed services) was clearly StarHub’s star last year, soaring 21% for the final three months and driving a 9% increase in the biz segment for the full year.

“Our Enterprise Fixed business plays a key role and it has registered a strong finish to the year with a second consecutive quarter of double-digit revenue growth. The strategy we have executed for our growth, such as our acquisitions of Accel and D’Crypt, is yielding results for us,” Tan said.

No such joy from pay-TV. Sadly.

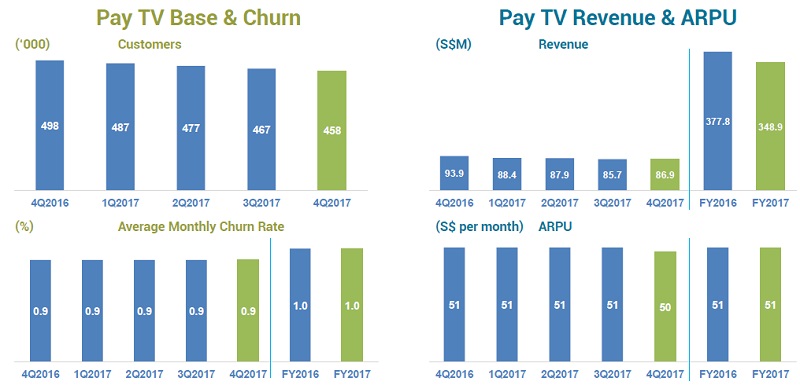

Pay TV revenue decreased 7% year-on-year to S$86.9 million/US$66 million for the final quarter of 2017 and dropped 8% for the full year to S$348.9 million/US$265 million.

The company blamed the decrease to the drop in subscribers to 458,000 households – a drop of 40,000 compared to the end of 2016.

Pay-TV average revenue per user (ARPU) for last year was S$50/US$38 – down S$1 – and churn was 1%.

Mobile revenue was down 2% for the full year t...

StarHub CEO, Tan Tong Hai, hurtles towards the end of his career at the Singapore telco with (clearly) undiminished enthusiasm for the company’s prospects after the door shuts behind him.

StarHub CEO, Tan Tong Hai, hurtles towards the end of his career at the Singapore telco with (clearly) undiminished enthusiasm for the company’s prospects after the door shuts behind him.

Just before the Lunar New Year weekend, less than three months before his exit on 1 May this year, Tan invested a little more than S$500,000/US$394,000 in company shares, which had dropped to six-month lows mid-Feb.

Tan notified the Singapore Stock Exchange on 15 Feb that he was buying 200,000 ordinary voting shares at S$2.59 per share, giving him a total of 754,854 shares – or a 0.04% stake in the company.

The disclosure came a day after the Valentine’s Day release of the company’s financials, which saw StarHub’s 2017 net profit slide by 27% to S$249.6 million/US$190 million.

In his comments on the results, Tan talked about “taking our customer-centric approach a step further by adopting a higher level of artificial intelligence to anticipate our customers’ needs” in 2018.

2018 “will also usher in changes to the competitive landscape and we are ready to seize opportunities offered by the market,” he added.

Enterprise fixed revenue (more specifically cyber security solutions and managed services) was clearly StarHub’s star last year, soaring 21% for the final three months and driving a 9% increase in the biz segment for the full year.

“Our Enterprise Fixed business plays a key role and it has registered a strong finish to the year with a second consecutive quarter of double-digit revenue growth. The strategy we have executed for our growth, such as our acquisitions of Accel and D’Crypt, is yielding results for us,” Tan said.

No such joy from pay-TV. Sadly.

Pay TV revenue decreased 7% year-on-year to S$86.9 million/US$66 million for the final quarter of 2017 and dropped 8% for the full year to S$348.9 million/US$265 million.

The company blamed the decrease to the drop in subscribers to 458,000 households – a drop of 40,000 compared to the end of 2016.

Pay-TV average revenue per user (ARPU) for last year was S$50/US$38 – down S$1 – and churn was 1%.

Mobile revenue was down 2% for the full year to S$1.2 billion/US$913 million, broadband revenue dropped 1% to S$214 million/US$163 million.

Service revenue for the quarter was 1% higher year-on-year at S$571.7 million/US$435 million but 1% lower for the full year at just under S$2.2 billion/US$1.7 billion.

Mobile makes us half of StarHub’s revenue. Pay-TV’s share of the mix dropped to 14.5% last year from 15.8% in 2016.