Hulu Japan celebrated its seventh anniversary in September, with the clock ticking on the premiere of its first Russian drama, zombie series The Day After, and still basking in the halo effect of original show Miss Sherlock, which was the platform’s first international co-production. Employee number one, chief content officer and board member Kazufumi Nagasawa, talks about hunting down titles from untapped catalogues to follow Australia’s Wentworth, Turkey’s Magnificent Century and Spain’s Locked Up, the advantages of joint rights acquisition, and how he’s dealing with the looming challenge of rivals such as Amazon Prime Video.

Hulu Japan premiered its first Russian series, zombie drama, The Day After, on 5 October, broadening its SVOD offering, introducing a new approach to sub-licensing and windowing, and paving the way for a broader selection of foreign acquisitions.

What is chief content officer, Kazufumi Nagasawa, up to with the zombies? The simple answer is programme diversity. The more complex answer is feeling his way through an evolving environment with different genres and a wider range of partnerships.

“Japan has so many OTT services, including of course the global platforms. Most of the programmes watched on those OTT platforms are either local, American or Korean, and some Chinese. That’s it. 99% or even 99.9% of viewing is from those four territories. What I want to do is give diversity, show content to our users that they cannot watch if we do not exist,” he says.

Sub-licensing deals around The Day After maximise every window and then some.

The Day After premiere on Hulu Japan was followed on 6 October by a first-episode special window on the country’s top commercial broadcaster, Nippon TV, which bought Hulu Japan in 2014. AVOD platform TVer, jointly owned by five Japanese terrestrial networks, has one-week catch-up rights. Sister Nippon satellite network, BS Nippon, will begin airing the series on 10 November 2018. Hulu Japan, whichacquired all rights from Russia’s Art Pictures, has also sub-licensed simultaneous DVD (rental/sell-through) rights to FOX Home Entertainment Japan (Twentieth Century Fox Home Entertainment).

Outlier acquisitions in the past have included Australian drama Wentworth, which was an unexpected hit. “We weren’t expecting a lot... but it ranked in the top 10 right away,” Nagasawa says. “Until then we were not really aggressive about acquiring English-language content not from the U.S. or U.K., but the success of Wentworth made us think a little bit differently, and we became more open to content from other territories,” he says.

Turkish drama was another eye-opener. Hulu Japan acquired Magnificent Century (Muhtesem Yuzyil), which it streamed with subtitles. Magnificent Century is an epic tale about Suleiman the Magnificent and Hurrem, the slave who became his wife. Like Wentworth, the series exceeded Hulu Japan’s expectations. “Magnificent Century opened our minds to a new opportunity... to bring content that is a mega-hit in its own markets around the world to Japanese audiences,” Nagasawa says.

The opportunity extends to Asian territories outside of Korea and China. “We are open to any content from any territories,” Nagasawa says, cautiously, lest anyone think it’s open day for forei...

Hulu Japan celebrated its seventh anniversary in September, with the clock ticking on the premiere of its first Russian drama, zombie series The Day After, and still basking in the halo effect of original show Miss Sherlock, which was the platform’s first international co-production. Employee number one, chief content officer and board member Kazufumi Nagasawa, talks about hunting down titles from untapped catalogues to follow Australia’s Wentworth, Turkey’s Magnificent Century and Spain’s Locked Up, the advantages of joint rights acquisition, and how he’s dealing with the looming challenge of rivals such as Amazon Prime Video.

Hulu Japan premiered its first Russian series, zombie drama, The Day After, on 5 October, broadening its SVOD offering, introducing a new approach to sub-licensing and windowing, and paving the way for a broader selection of foreign acquisitions.

What is chief content officer, Kazufumi Nagasawa, up to with the zombies? The simple answer is programme diversity. The more complex answer is feeling his way through an evolving environment with different genres and a wider range of partnerships.

“Japan has so many OTT services, including of course the global platforms. Most of the programmes watched on those OTT platforms are either local, American or Korean, and some Chinese. That’s it. 99% or even 99.9% of viewing is from those four territories. What I want to do is give diversity, show content to our users that they cannot watch if we do not exist,” he says.

Sub-licensing deals around The Day After maximise every window and then some.

The Day After premiere on Hulu Japan was followed on 6 October by a first-episode special window on the country’s top commercial broadcaster, Nippon TV, which bought Hulu Japan in 2014. AVOD platform TVer, jointly owned by five Japanese terrestrial networks, has one-week catch-up rights. Sister Nippon satellite network, BS Nippon, will begin airing the series on 10 November 2018. Hulu Japan, whichacquired all rights from Russia’s Art Pictures, has also sub-licensed simultaneous DVD (rental/sell-through) rights to FOX Home Entertainment Japan (Twentieth Century Fox Home Entertainment).

Outlier acquisitions in the past have included Australian drama Wentworth, which was an unexpected hit. “We weren’t expecting a lot... but it ranked in the top 10 right away,” Nagasawa says. “Until then we were not really aggressive about acquiring English-language content not from the U.S. or U.K., but the success of Wentworth made us think a little bit differently, and we became more open to content from other territories,” he says.

Turkish drama was another eye-opener. Hulu Japan acquired Magnificent Century (Muhtesem Yuzyil), which it streamed with subtitles. Magnificent Century is an epic tale about Suleiman the Magnificent and Hurrem, the slave who became his wife. Like Wentworth, the series exceeded Hulu Japan’s expectations. “Magnificent Century opened our minds to a new opportunity... to bring content that is a mega-hit in its own markets around the world to Japanese audiences,” Nagasawa says.

The opportunity extends to Asian territories outside of Korea and China. “We are open to any content from any territories,” Nagasawa says, cautiously, lest anyone think it’s open day for foreign content acquisitions on the platform. While shelf space is, technically, unlimited, the platform remains realistic about culture and cost, including the high costs of localisation.

The preference is for domestic mega-hits and volume, and high definition. “We are open to acquiring content from any part of the world but we’d rather go with a proven track record, a mega hit, and we need volume. It doesn’t make sense to allocate resources to launching mini series from unknown territories. We would rather go with series that already have multiple seasons and many episodes,” Nagasawa says.

Exclusivity is a moving target. Nagasawa describes Hulu Japan’s approach as “flexible”. Hulu original, The Handmaid’s Tale, for instance, is exclusive to Hulu Japan in Japan. But he is more than happy to share rights on The Day After, including airing the premiere in a regular slot on Nippon TV’s terrestrial channel to promote new seasons of shows – particularly unknown shows – on Hulu Japan.

Turkey’s Magnificent Century broke the rights mould in its own way. The series was a joint acquisition with the NEP division of Japanese public broadcaster NHK. Nagasawa says the joint acquisition was unusual. “We came to know that we were both chasing the same title so we decided to do it together,” he says. The advantages are, primarily, sharing the risk. In this case, NEP’s relationship with pay-TV channel, Channel Ginga, was an added benefit. The series was licensed to Channel Ginga, which targets older audiences.

Did he expect a Japanese audience of 70+ years old to take to a Turkish drama aired with Japanese subtitles in such a big way? Maybe a little. “It’s surprising, but the thing is, they are used to watching Korean period drama. And in essence it’s quite similar,” Nagasawa says.

As Amazon gains strength in Japan, Hulu Japan has stared down the giant. And lost. Or won, depending on how you look at it.

Amazon Prime offers an annual subscription of about US$35 a year, and the platform is estimated to have double the number of subscribers. “In some senses, it’s a huge threat.... but on the other hand, they are cultivating a new market for OTT service and for specific content”.

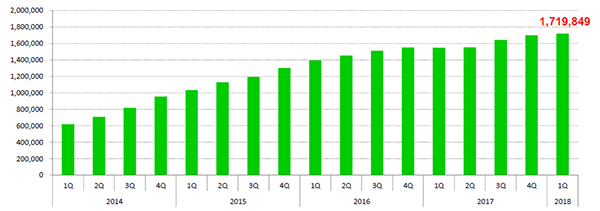

Source: HJ Holdings. Hulu Japan added 18,730 subscribers in the first quarter of FY2018 to end June, reaching almost 1.72 million subscribersand said it was on track to reach the goal of 1.8 million subscribers by the end of FY2018n at end March 2019

Game of Thrones is an example. The first six seasons of Game ofThrones migrated from Hulu Japan to Amazon Prime earlier this year, leaving Hulu Japan with exclusive rights only to season seven. “Amazon launched Game of Thrones until season six and, as a result of that, our viewership for season seven increased dramatically. So, yes, it should be fair to say there’s a huge threat. But on the other hand, we’re cultivating the market together”.

Hulu has a few advantages, the prime one being the exclusive catch-up service for Nippon TV, the top-ranked terrestrial channel in Japan across all time bands, as well as the exclusive platform for Nippon TV spin-offs.

“Spinoff might be a misleading word. It makes it sound a little bit tiny but it’s not tiny in reality,” Nagasawa says. The spin-offs vary; they might be a part of a character’s story, a prequel, or even a different ending.

“It’s working super well, and is one of the most important differentiators for us,” he adds.

Reporting its financials for the first quarter (April-June 2018) of the 2018 financial year, Nippon TV said Hotel on the Brink! and Zero – The Bravest Money Game had been well received. “Hulu will continue to aggressively produce original spinoffs of Nippon TV dramas,” the company said at the end of July.

“The fact that we are owned by Nippon TV is obviously the most important differentiator. Another important competitive edge is that we are a local player. We can adjust ourselves to the needs of the market,” he says.

And then there’s the Hulu Japan Originals strategy, which ramped up last year with the first international co-production, Miss Sherlock, with HBO Asia. Miss Sherlock is an eight-episode contemporary female-led series based on Sir Arthur Conan Doyle’s classic and set in Tokyo with Yuko Takeuchi as Miss Sherlock and Shihori Kanjiya as Dr Watson.

Miss Sherlock was Hulu Japan’s number one show during its run. The release strategy matched HBO Asia’s release of one show a week for eight weeks. “In this case we had no choice because we had to be day-and-date with HBO,” he says. But the benefits are clear in the increased promotional opportunities, and the longer potential subscription period. “If we launch everything at once, there are those who come in and stay just for one month,” he says.

The biggest learning on international co-productions was how difficult it was (and is) to find a show with the potential to work in Japan for Hulu and in other territories for partners, in this case HBO Asia. Nagasawa is not deterred: “If you can come up with the right material, it’s a great way to do it because we can share the risk”.

Published in ContentAsia's Issue Five 2018, 4 October 2018