APRIL 2019: Asia closed 2018 with 337 formats on air or commissioned across the region. Thailand was the biggest winner, topping the list with 70 titles. Vietnam came in second, but the win is a bit hollow given the volume of previous years. The good news is that high-end scripted/drama format acquisitions are up, gains are being made in China, and Korea is all smiles about The Masked Singer in the U.S.

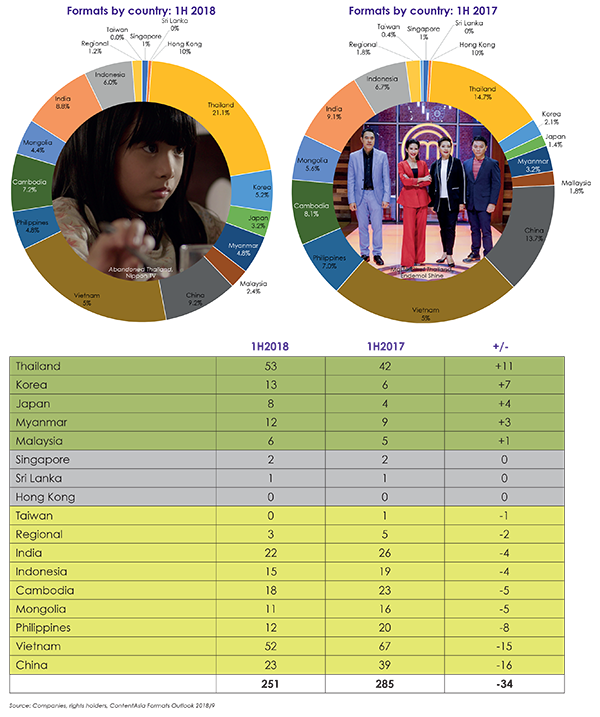

Asia’s formats business ended 2018 in a decent enough place – a relief given the sharp mid-year dip, when only five of 17 markets across the region were up, three had recorded zero growth, and the rest were down, some more dramatically than others.

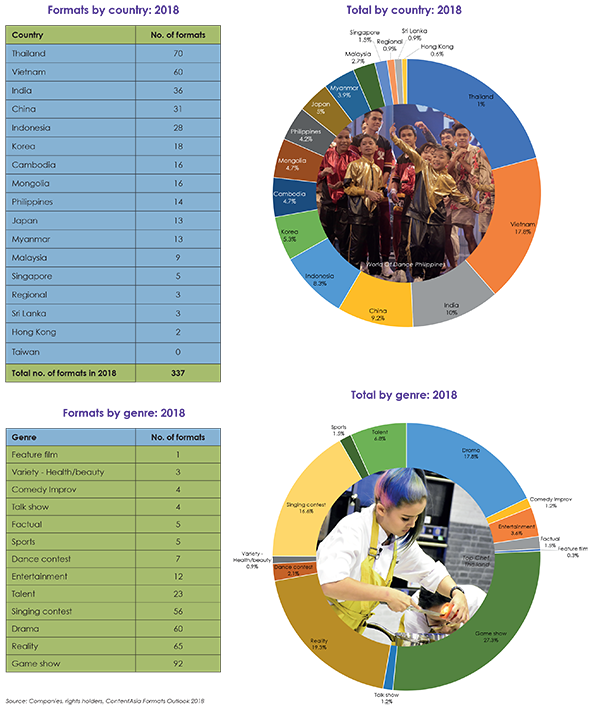

ContentAsia’s Format’s Outlook recorded a total of 337 formats on air in 2018 or commissioned for 2019, higher interest in scripted format acquisitions, and Thailand as well as India riding high with their best numbers in the three years we have been counting.

But there were mixed fortunes elsewhere in the region in 2018. Vietnam ended the year with 60 titles, down from about 68 in 2017 and 65 in 2016, when the country topped the list of formats acquisitions across all markets in Asia by volume. 2016 closed with a total of approx 329 formats on air across the region or commissioned for 2017. Until September 2017, broadcasters in the regional had acquired 292 formats for the year, closing with estimates of above 320.

The biggest winner by far in 2018 was Thailand, which ended 2018 with 70 formats, up from 45 in 2017 (to end Sept 2017) and 47 in 2016 (to end November 2016).

In 2018, India was also at its most vibrant in three years, with 36 titles, including drama formats Criminal Justice India (BBC Studios), False Flag India (Keshet International) and Liar India (all3media Int’l). In 2017, India logged 26 titles until end Sept. In 2016, ContentAsia’s Formats Outlook counted 31 titles for India until the end of November.

China, perhaps not surprisingly given ongoing regulations that disadvantage foreign rights holders, is a chart dropper, entering our 2018 list in fourth spot with 31 titles. In 2017, China acquired 38 formats. This was a fraction of the 54 formats we counted in 2016, when China ran second only to Vietnam in volume and topped the list in dollar value.

Whatever their placement, India, Thailand, China and Vietnam continue to hold the top four positions, with Philippines and Cambodia in fifth place in 2016 with 27 titles each. Cambodia took fifth in 2017 with 23 titles. Philippines had 21 in 2017, pushing the m...

APRIL 2019: Asia closed 2018 with 337 formats on air or commissioned across the region. Thailand was the biggest winner, topping the list with 70 titles. Vietnam came in second, but the win is a bit hollow given the volume of previous years. The good news is that high-end scripted/drama format acquisitions are up, gains are being made in China, and Korea is all smiles about The Masked Singer in the U.S.

Asia’s formats business ended 2018 in a decent enough place – a relief given the sharp mid-year dip, when only five of 17 markets across the region were up, three had recorded zero growth, and the rest were down, some more dramatically than others.

ContentAsia’s Format’s Outlook recorded a total of 337 formats on air in 2018 or commissioned for 2019, higher interest in scripted format acquisitions, and Thailand as well as India riding high with their best numbers in the three years we have been counting.

But there were mixed fortunes elsewhere in the region in 2018. Vietnam ended the year with 60 titles, down from about 68 in 2017 and 65 in 2016, when the country topped the list of formats acquisitions across all markets in Asia by volume. 2016 closed with a total of approx 329 formats on air across the region or commissioned for 2017. Until September 2017, broadcasters in the regional had acquired 292 formats for the year, closing with estimates of above 320.

The biggest winner by far in 2018 was Thailand, which ended 2018 with 70 formats, up from 45 in 2017 (to end Sept 2017) and 47 in 2016 (to end November 2016).

In 2018, India was also at its most vibrant in three years, with 36 titles, including drama formats Criminal Justice India (BBC Studios), False Flag India (Keshet International) and Liar India (all3media Int’l). In 2017, India logged 26 titles until end Sept. In 2016, ContentAsia’s Formats Outlook counted 31 titles for India until the end of November.

China, perhaps not surprisingly given ongoing regulations that disadvantage foreign rights holders, is a chart dropper, entering our 2018 list in fourth spot with 31 titles. In 2017, China acquired 38 formats. This was a fraction of the 54 formats we counted in 2016, when China ran second only to Vietnam in volume and topped the list in dollar value.

Whatever their placement, India, Thailand, China and Vietnam continue to hold the top four positions, with Philippines and Cambodia in fifth place in 2016 with 27 titles each. Cambodia took fifth in 2017 with 23 titles. Philippines had 21 in 2017, pushing the market into sixth spot.

In 2018 Thailand rocked game shows and entertainment, with local versions of regional and international formats including the first local version of The Voice Senior (Talpa) in Asia, World of Dance Thailand (NBCUniversal), Shark Tank Thailand (Sony Pictures Television) and Noisy Neighbours (TV Asahi, Japan).

Among the biggest trends is the rise of scripted/drama formats acquisitions and the rising confidence of local creators who see a chance to spread their IP around the world. These include Hunan TV’s The Rocking Bridge and Zense Entertainment’s Singer Auction and The Producer out of Thailand. Japan is shifting the scripted needle. Nippon TV continues to capture Turkish drama attention and Fuji TV has sold remake rights to about 40 of its drama series to Chinese media companies.

Published in April 2019 in ContentAsia print+online magazine for MIP TV 2019