Asia’s formats environment has changed dramatically in the past three years. The response, industry leaders say, is flexibility, collaboration and to solve for different problems. Plus a breakdown of formats in the region from January to September 2024.

If Vietnam recorded the most formats by volume in the first nine months of this year, India took the headline lead in the last quarter, capped at the end October with the announcement that Goldie Behl’s Rose Audio Visuals and global indie All3Media International were working on an Indian version of Studio Lambert’s unscripted series, Buy it Now. The show, a departure for Rose Audio Visuals, known for its scripted productions, focuses on “turning local inventions into national sensations”.

Rose Audio’s move into unknown territory could be seen as a sign of the times – a hunt for new opportunities and unexplored potential by everyone everywhere. “We see great potential in unscripted formats for Indian audiences… at a time when innovation and entrepreneurship are thriving across the country,” Rose Audio Visuals’ COO, Mitesh Patel, said when the deal was announced. The platform partners had not been announced at presstime.

The Buy It Now pick-up announcement coincided with the premiere of Asia’s first adaptation of NBCUniversal Formats’ Million Dollar Listing. The real estate reality series debuted on 25 October on Indian streamer Sony LIV. In another sign of the times, the unscripted real estate format is produced by sometimes-rival-often friend, Banijay Asia, which is forging new domestic and regionals paths out of its Mumbai HQ for both originals and formats.

The India hat-trick kicked off in the second half of September with the first Asian version of The Traitors, also from All3Media International. The unscripted series, which involves 20 players competing for a cash prize in a game of trust and deception, will stream on Prime Video India in Hindi with English subtitles in 2025. Karan Johar hosts the India version, currently in production by BBC Studios India Productions led by Sameer Gogate, GM, BBC Studios India Productions.

The three high-profile announcements are consistent with the vibrant and ongoing interest in unscripted formats in Asia.

For the first nine months of 2024, unscripted titles outstripped scripted by 91 to 27, according to ContentAsia’s Formats Outlook. Of the total 118 format adaptations recorded to end September, 53 (45%) were reality shows. Of these, 23 titles involved singing, cooking, social experiment, business, dating, fashion/beauty, factual, talent, romance, dancing and improvised comedy.

Game shows in the first nine months of this year accounted for 27% (32 titles) while drama series made up 23% (27 titles), according to ContentAsia’s Formats Outlook for January to September 2024.

SINGING

Come January 2025, S...

Asia’s formats environment has changed dramatically in the past three years. The response, industry leaders say, is flexibility, collaboration and to solve for different problems. Plus a breakdown of formats in the region from January to September 2024.

If Vietnam recorded the most formats by volume in the first nine months of this year, India took the headline lead in the last quarter, capped at the end October with the announcement that Goldie Behl’s Rose Audio Visuals and global indie All3Media International were working on an Indian version of Studio Lambert’s unscripted series, Buy it Now. The show, a departure for Rose Audio Visuals, known for its scripted productions, focuses on “turning local inventions into national sensations”.

Rose Audio’s move into unknown territory could be seen as a sign of the times – a hunt for new opportunities and unexplored potential by everyone everywhere. “We see great potential in unscripted formats for Indian audiences… at a time when innovation and entrepreneurship are thriving across the country,” Rose Audio Visuals’ COO, Mitesh Patel, said when the deal was announced. The platform partners had not been announced at presstime.

The Buy It Now pick-up announcement coincided with the premiere of Asia’s first adaptation of NBCUniversal Formats’ Million Dollar Listing. The real estate reality series debuted on 25 October on Indian streamer Sony LIV. In another sign of the times, the unscripted real estate format is produced by sometimes-rival-often friend, Banijay Asia, which is forging new domestic and regionals paths out of its Mumbai HQ for both originals and formats.

The India hat-trick kicked off in the second half of September with the first Asian version of The Traitors, also from All3Media International. The unscripted series, which involves 20 players competing for a cash prize in a game of trust and deception, will stream on Prime Video India in Hindi with English subtitles in 2025. Karan Johar hosts the India version, currently in production by BBC Studios India Productions led by Sameer Gogate, GM, BBC Studios India Productions.

The three high-profile announcements are consistent with the vibrant and ongoing interest in unscripted formats in Asia.

For the first nine months of 2024, unscripted titles outstripped scripted by 91 to 27, according to ContentAsia’s Formats Outlook. Of the total 118 format adaptations recorded to end September, 53 (45%) were reality shows. Of these, 23 titles involved singing, cooking, social experiment, business, dating, fashion/beauty, factual, talent, romance, dancing and improvised comedy.

Game shows in the first nine months of this year accounted for 27% (32 titles) while drama series made up 23% (27 titles), according to ContentAsia’s Formats Outlook for January to September 2024.

SINGING

Come January 2025, Singapore joins the ranks of high-profile singing shows with the first version of Korean singing-related game show format, I Can See Your Voice. The mystery music show, produced by Mediacorp Studios, premieres in January. The commission, announced in mid-2024, brings to an end Singapore’s dry spell of big-brand international song-formats that persisted for almost two decades. The last singing-related international format aired in Singapore was Singapore Idol, which premiered in 2004 and returned for a second season in 2006.

CJ ENM’s I Can See Your Voice is a long-running favourite across Southeast Asia. Malaysia and Thailand are both on season seven, and the Philippines is on season eight.

Vietnam also retains a strong appetite for multiple seasons of big-brand properties, including versions of ITV Studios’ The Voice.

For the nine months to end September 2024, Vietnam also had the most singing formats.

Four titles were commissioned/underway/on-air of a total of nine reality formats reported. These included The Voice Kids Vietnam season eight; Beautiful Sisters Riding Waves from China’s Mango TV; and two seasons of Singer Auction Vietnam (seasons five and six) from NBCUniversal Formats. All four were commissioned by state-owned free-TV broadcast network, Vietnam Television (VTV3).

Elsewhere in the region, Mongolia, the Philippines and Sri Lanka recorded three singing formats each during the same period.

Mongolia’s pick-ups included Banijay Rights’ Killer Karaoke Mongolia season one, commissioned by free-TV channel Central TV, and Your Face Sounds Familiar Mongolia season seven greedlit by Edutainment TV; and ITV Studios’ The Voice Kids Mongolia season one for free-TV service, Mongol TV.

In the Philippines, ContentAsia’s Formats Outlook counted three singing formats, all from ITV Studios – The Voice Kids Philippines seasons six/seven and The Voice Teens Philippines season three.

Similarly in Sri Lanka, all three singing formats were from ITV Studios – The Voice Generations Sri Lanka season two, The Voice Kids Sri Lanka season one, The Voice of Sri Lanka season three. All were commissioned by the Capital Maharaja Group’s MTV Channels.

GAME SHOWS

Game show adaptations reigned in Vietnam, Mongolia and Thailand.

Vietnam recorded seven adaptations, including local remakes of CJ ENM Korea’s My Boyfriend is Better, commissioned by FPT Play; All3Media International’s Beat the Internet Vietnam and Cash Cab Vietnam, both commissioned by VTV8; and Banijay Rights’ Million Dollar Minute Vietnam season nine, locally known as Mot tram trieu mot phut, by VTV3.

Game shows made up 37% of the total 19 formats in the country during the first nine months of this year.

Mongolia recorded six game show titles (on par with reality formats), out of a total 14 formats during the first nine months of this year.

Titles included All3Media International’s Cash At Your Door Mongolia season four for Edutainment TV and Cash Cab Mongolia for NTV; Spelling Star season three from Banijay Rights, commissioned by Edutainment TV; and Fremantle’s Family Feud Mongolia for Star TV and Total Black Out Mongolia season three for Edutainment TV.

Thailand was third, with four titles – First and Last Thailand seasons seven and eight from Banijay Rights for Bangkok Broadcasting & TV (BBTV Channel 7); Fremantle’s Family Feud Thailand for The One Enterprise (One31); and NBCUniversal Formats’ Hollywood Game Night Thailand season seven, commissioned by BEC World (Channel 3).

SCRIPTED

Thailand ended September in the scripted lead, with seven titles commissioned/on-air by platforms operating locally, followed by India with five and Korea with four titles.

In Thailand, drama adaptations included TV Tokyo’s Cherry Magic, itself a remake of the Japanese drama Cherry Magic! Thirty Years of Virginity Can Make You a Wizard?!, about Kiyoshi Adachi, a 30-year-old virgin who gains a magical power that allows him to read people’s minds by touching them; CJ ENM Korea’s medical drama Emergency Couple; romcom Familiar Wife Thailand; thriller Law-less; and Good Doctor Thailand from Korea’s KBS Media for TrueVisions (TrueID), which premiered in October and runs to December. Emergency Couple, Familiar Wife Thailand and Law-less are also part of the True offering.

India was second to Thailand with five drama titles, including season four of Criminal Justice from BBC Studios for Disney+ Hotstar; Aarya season three from Banijay Rights for Disney+ Hotstar; and All3Media International’s The Tourist, which was announced in July 2024 in a deal with Banijay Asia.

Banijay Asia, which has been behind local adaptations of The Night Manager, The Trial (The Good Wife) and Call My Agent Bollywood, says it chose The Tourist because of its “unique blend of mystery and suspense”.

The latest deal brings The Tourist, about an Irishman who wakes up in an Australian hospital with amnesia after a car crash, to Asia for the first time, and, although second to Thailand in volume in 2024, is likely to be in the lead in budget and scale.

From 2017 to the end of 2023, India had adapted upwards of 220 international formats, including 66 drama adaptations, giving the genre an average 30% share of India’s formats market. Thirteen of the 29 titles adapted in 2023 were drama series, including Kafas (The Forge’s Dark Money), Good Doctor India, Rana Naidu (Ray Donovan) season two, and Tanaav (Fauda) season two, according to ContentAsia’s Formats Outlook.

Korea ranked third behind Thailand and India for scripted formats, accounting for four titles: Tell Me That You Love Me, based on 1995 Japanese TV series Aishiteiru to Itte Kure from TBS Japan, commissioned by Studio Genie/ENA; Family by Choice, a remake of the Chinese title Go Ahead from Huace Film & TV, for JTBC Studios/SLL; romcom Love Undercover, adapted from Turkish series Ruhun Duymaz from Inter Medya; and Your Honor, a remake of Israel’s Kovodo from Yes Studios for KT Genie TV.

The four drama adaptations in Korea accounted for the majority of the country’s total format count for the first nine months of this year. The others are two seasons of variety show Saturday Night Live Korea (seasons four and five) from NBCUniversal Formats; and one music show, Tiny Desk Korea, a remake of Tiny Desk Concert from NPR, brokered by Korea’s Something Special.

In Japan, Mother, about a teacher who impulsively abducts a young student she knows is being abused by her own mother, is the gift that keeps on giving for Japanese free-TV broadcaster, Nippon TV. A Philippines’ version – Saving Grace – is on its way in 2025 in an adaptation by ABS-CBN/Dreamscape. Julia Montes stars in the local version, which is Dreamscape’s first adaptation of a Nippon TV show. In Asia, Mother has also been adapted in Korea, Thailand, China and Mongolia. In October this year, Nippon TV said Greece’s Alpha TV had commissioned a Greek version – Na me les mama (Call me Mom) – giving the series its 11th international adaptation and cementing the Japanese drama series as Asia’s #1 scripted export.

BY COUNTRY

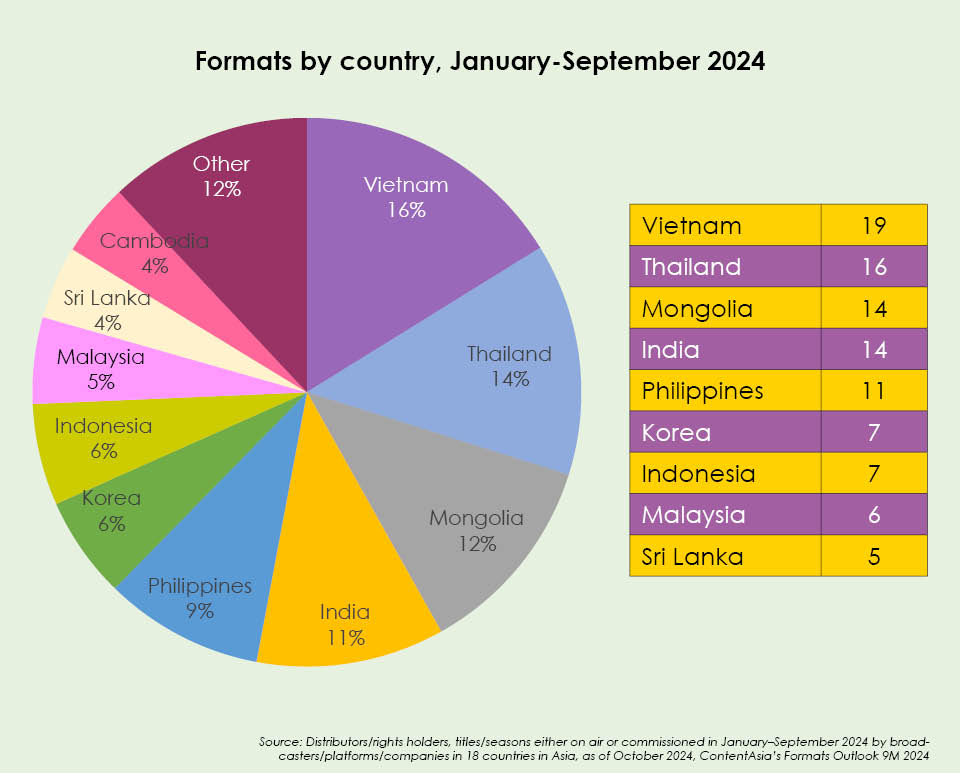

At least 118 adaptations were commissioned, underway or on air in Asia in the first nine months of this year. Vietnam led with 19 titles (16%), followed by Thailand with 16 titles (14%) and Mongolia with 14 titles (12%).

Of Vietnam’s 19 adaptations, nine were reality and seven were game shows, with one each for variety, drama and music.

Thailand’s16 adaptations involved seven dramas, five reality shows, and four game shows.

India recorded 14 titles (seven reality, five drama, and two game shows) from January to September 2024.

Mongolia reported a total of 14 adaptations (6 reality, 6 game shows, 2 drama) for the first nine months of this year.

The Philippines reported 11 adaptations (seven reality, three drama and one game show), while Sri Lanka had five (three reality shows and two game shows) for the first nine months of this year.

AND NOW WHAT...

In the current environment and with all the uncertainty media companies are facing, producers and platforms are hyper-focused on reducing risk.

“Formats is one of the answers. Not the only one, but one of the ways to reduce risk. That’s what we have been working on with our clients,” says All3Media International’s Asia Pacific EVP, Sabrina Duguet.

What’s not working is creating a show – or trying to – specifically for an international market. “This sounds so obvious, but a show needs to have worked really well in one country,” Duguet says.

“I’m saying that because more and more we see people wanting to do formats to export. And yes, of course, we all want our formats to sell worldwide, but at the end of the day, when you create a show, it needs to work for your country,” she adds.

Duguet says the formats industry is currently walking two distinct paths. One focuses on mega shows, the must-have already-proven success. The other is what she calls the “comfort zone” – “sometimes lower budget but a brand we know has worked, where we can do a bit more volume and recoup the investment across a lot of episodes”.

She adds that the rise in All3Media’s scripted profile has followed the company’s acquisition of high-end drama companies over the past seven years. This has run alongside higher market demand. “In Asia, where obviously local content is key, demand for scripted series has increased, and therefore, I think the mix of both made it the perfect timing for us to grow that business here,” she says.

Speaking during the ContentAsia Summit in Taiwan in September 2024, Duguet said All3Media had sold 17 scripted formats in six or seven territories across Asia in the past few years, with another 10 or so in development with various partners. About 80% of these are crime/detective/thriller. “It is something that we do a lot more of, but it also shows the demand of the market,” she said.

Mrinalini Jain, group chief development officer for Banijay Asia & Endemol Shine India, points out an expected decline of about 20% in overall commissioning of content in India in 2024, from a total of 206 titles in 2023. As of June 2024, about 75 titles had been greenlit, with year-end numbers expected to end at 150.

Platform consolidation in India, with the number of buyers shrinking from 11 in the past year to about five, is the primary reason, Jain says. “The consolidation of buyers and platforms has greatly impacted the kind of decisions platforms will make towards the kind of content they want to offer,” she says.

“It’s definitely a challenging time... I wouldn’t view it just from a formats perspective,” she adds.

In India, Banijay makes Big Brother in seven languages, Fear Factor, which has been ongoing for about 16 years, and MasterChef in three languages. “The ones that were there have stayed,” she says.

Big-brand, long-running formats are perhaps faring better than new titles, with India’s free-to-air channels favouring unscripted and SVOD services aligning with scripted.

The thinking is that high-profile shows, with big-name stars, writers and directors, are great for customer acquisition. In a slower market, this means fewer but bigger titles. “But what happens on retention? What happens when the show is over? What do you entertain consumers with?” Jain asks.

Diversity remains key, she says. “Today, every viewer wants a unique experience... consumers are very hard to please.”

“But I do think that this entire piece is short lived and ever-evolving. I feel the market is slowly shifting towards being okay with the risk, at least in India, saying that ‘okay, if nothing is working, what is the best we can do now?’ We just have to reinvent. We have to take the risk,” Jain says.

Jin Woo Hwang, founder and president of Something Special, Korea’s first independent agency specialising in formats, says the decrease in the overall number of format adaptations in Asia has been followed by spikes in countries like Japan, which is much more open to format acquisitions now than it has been in the past. Hwang attributes this to demand from streaming platforms.

He also notes greater diversification in size, genre and subject of formats. This is the driver behind the Something Special slate, which ranges from Unforgettable Duet to Penthouse Game to comedy, dating shows, and scripted.

Unforgettable Duet is an original unscripted series that follows a dementia patient whose families gather mementos and a favourite song to help them recall the past. The show was created and produced by Something Special and Eun-seol Mo (creator of Netflix’s Culinary Class War), and co-produced with Studio Rudolph. Penthouse Game, which aired on Channel A with a streaming window on Korean platform Wavve, is a reality game show featuring individuals going through financial difficulties. Chonjang Entertainment’s I am Single, which airs on ENA and SBS Plus, is a hyper-realistic dating show where 12 singles who desperately want to marry come to stay for six days.

Something Special also has international rights to Nmedia’s celebrity game show, Battle in the Box, which features two celebrity teams who, armed only with their toothbrushes, enter an empty box divided by a movable wall. Interstellar has an option for the U.S., following the successful production of the U.K. version this year on UK TV’s U&Dave TV.

Even though Korea’s The Masked Singer was toppled from its spot as the world’s top format this year by The Traitors, Hwang says Korean formats “are still selling pretty well”. The market challenge, he adds, is coming up with a steady stream of new ideas, regardless of local funding and budget issues.

There’s no shortage of new ideas on digital/social media, says Linfield Ng, NBCUniversal Formats’ vice president, format distribution and production, Asia.

He mentions YouTube shows like XYOB and Hong Seok Cheon’s Jewelry Box... “There’s all this new, interesting YouTube content that’s exploding and that makes regular TV formats challenging on many levels. These digital shows are short, they’re fun, they’re very easy to entertain and engage audiences, an audience these days with a very, very short attention span. If you’re not fun or interesting, you are just switched off.”

At the same time, big brands still sell and major sponsors still gravitate towards these. For example, Top Chef and The Real Housewives... Beyond those, Ng does his best to find NBCU titles with particular resonance in specific markets and with particular partners in Asia. This led him to Singer Auction in Vietnam and photography competition, Master of Photography, in Mongolia.

Duguet agrees. “It’s not enough that a show is good for it to travel,” she says. “Every single decision along the way will have an impact. Who are you going to collaborate with. Who is the best partner? One might be the best for one show, but the competitor will be the best for another show... it’s when knowing your client becomes everything.”

As difficult as these sometimes are, co-production and co-development are crucial, Hwang says.

Duguet says the most difficult version of this is the co-creation of a show. “You have two creative teams from two different countries with two different backgrounds trying to agree on creative... we can all agree this is a nightmare”. She says what works better creatively is for one of the partners to take the lead “a little more”.

“All of us are thinking the same thing,” Ng says. The new environment “forces us to be so much more creative and flexible, creatively and commercially, on many levels”.