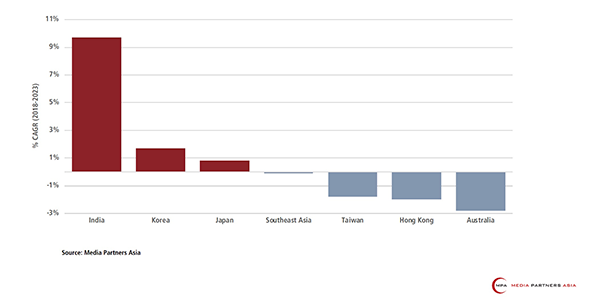

Key territories: Pay-TV channel & content providers (total revenue growth % CAGR)

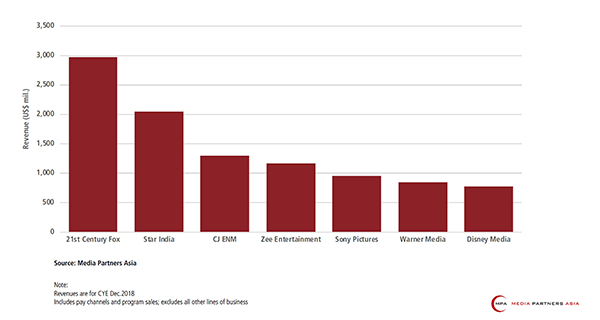

Leading regional pay-TV broadcasters & content providers, Asia Pacific

That big fear that has been looming over much of Asia’s pay-TV industry in the past few years? Well it’s here. Full blown, foul, fuelled by numbers that show deep, dark and serious challenges across Southeast Asia, Australia, New Zealand and Taiwan.

India and South Asia have not only been spared, but have been singled out for major growth in Media Partners Asia’s (MPA) latest forecasts. Subscriber growth in Korea has moderated, but remains robust, and the Philippines’ subs outlook isn’t looking anywhere near as bad as anything its Southeast Asian neighbours face.

China, India, Korea and Japan will power future growth. MPA forecasts a 3% CAGR in Asia Pacific pay-TV revenue from 2018-23. By 2023, pay-TV revenue will total US$25 billion in China, US$16 billion in India, US$7.4 billion in Korea and US$7.1 billion in Japan, MPA’s Asia Pacific Pay-TV Distribution report shows. The pay-TV base in the region will grow 2% CAGR from 645 million subscribers in 2018 to 696 million by 2023.

“Pay-TV stakeholders are adjusting to new realities as the industry shifts to IP-based distribution. The growth of high-speed broadband and online video is driving fundamental changes in content consumption and investment across key markets. This, together with piracy, will continue to adversely impact pay-TV industry growth,” MPA says.

MPA describes the current environment as a combo of slowdown and decline as key markets transition to online video and internet TV delivery. “Subscriber and ARPU growth is fundamentally challenged across much of Southeast Asia, Australia, New Zealand and Taiwan, and advertising is under pressure across most markets ex-India,” he says.

“In the context of such challenge, most pay-TV operators are rationalising content budgets, investing mostly in their own channels, local and Asian channels and sports rights, while rationalising spends on third-party channels across Hollywood entertainment, kids, factual and lifestyle,” Couto adds.

Content spend across a number of these genres has started to move online with the growth of OTT. At the same time, large scale IP-owners in entertainment and sports are likely to move direct-to-consumer with OTT offerings of their own.

Global media M&A will have a sign...

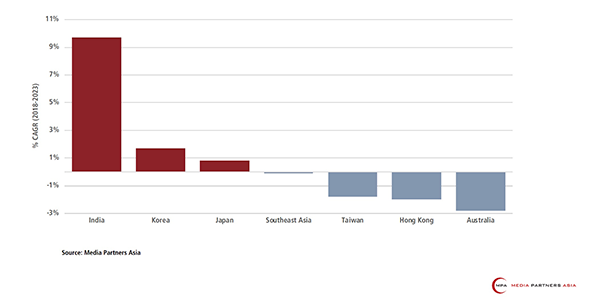

Key territories: Pay-TV channel & content providers (total revenue growth % CAGR)

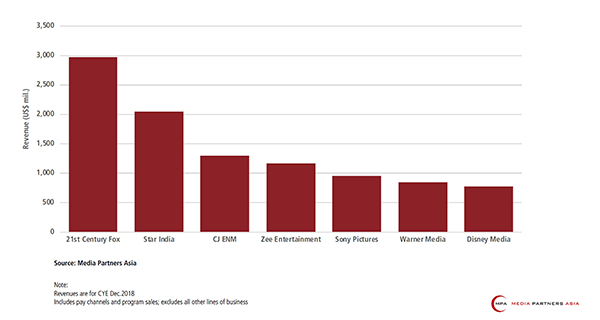

Leading regional pay-TV broadcasters & content providers, Asia Pacific

That big fear that has been looming over much of Asia’s pay-TV industry in the past few years? Well it’s here. Full blown, foul, fuelled by numbers that show deep, dark and serious challenges across Southeast Asia, Australia, New Zealand and Taiwan.

India and South Asia have not only been spared, but have been singled out for major growth in Media Partners Asia’s (MPA) latest forecasts. Subscriber growth in Korea has moderated, but remains robust, and the Philippines’ subs outlook isn’t looking anywhere near as bad as anything its Southeast Asian neighbours face.

China, India, Korea and Japan will power future growth. MPA forecasts a 3% CAGR in Asia Pacific pay-TV revenue from 2018-23. By 2023, pay-TV revenue will total US$25 billion in China, US$16 billion in India, US$7.4 billion in Korea and US$7.1 billion in Japan, MPA’s Asia Pacific Pay-TV Distribution report shows. The pay-TV base in the region will grow 2% CAGR from 645 million subscribers in 2018 to 696 million by 2023.

“Pay-TV stakeholders are adjusting to new realities as the industry shifts to IP-based distribution. The growth of high-speed broadband and online video is driving fundamental changes in content consumption and investment across key markets. This, together with piracy, will continue to adversely impact pay-TV industry growth,” MPA says.

MPA describes the current environment as a combo of slowdown and decline as key markets transition to online video and internet TV delivery. “Subscriber and ARPU growth is fundamentally challenged across much of Southeast Asia, Australia, New Zealand and Taiwan, and advertising is under pressure across most markets ex-India,” he says.

“In the context of such challenge, most pay-TV operators are rationalising content budgets, investing mostly in their own channels, local and Asian channels and sports rights, while rationalising spends on third-party channels across Hollywood entertainment, kids, factual and lifestyle,” Couto adds.

Content spend across a number of these genres has started to move online with the growth of OTT. At the same time, large scale IP-owners in entertainment and sports are likely to move direct-to-consumer with OTT offerings of their own.

Global media M&A will have a significant impact in Asia as key players grow scale through the consolidation of channels and IP under one roof, creating more synergies and bargaining power in the process, Couto says. Following Fox/Disney, WarnerMedia (Warner Bros, HBO, Turner); and Discovery/Scripps, MPA flags more consolidation, with A+E and Sony among the most likely candidates.

Pay-channel subscription fees are expected to grow at 2% CAGR over 2018-23 to US$10.8 billion by 2023. India will remain a key growth driver while Australia, Japan and Korea will remain scalable for incumbents. “There will continue to be significant rationalisation in Southeast Asia, Hong Kong and Taiwan,” Couto says.

Net advertising revenues are expected to grow at 5% CAGR over 2018-23 to reach US$16 billion, driven largely by growth in India.

India’s importance as a mainstay for pay channels will only be underscored by 2023 as it will contribute almost 50% to the Asia ex-China pay channel and CP revenue pie.

Seven media groups – 21st Century Fox, Disney, Sony, WarnerMedia, CJ, Sun TV, Zee – have more than 40% share of revenues accruing to channels and content providers from the Asia ex-China pay-TV industry in 2018. The remainder is split between international groups (Discovery and Viacom for instance), strong local incumbents (India, Japan, Korea, Taiwan), successful new entrants (BeIn Sports) and pay-TV operator invested channels.

Published in Issue Seven of ContentAsia's in-print + online 2018 (December 2018)