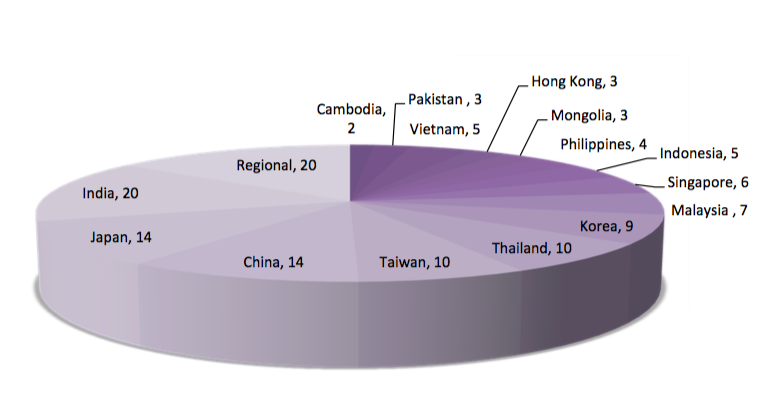

By mid-November, we had 135 active streaming services in 17 countries in Asia on our radar. These include big brand players we’ve known and loved from the traditional TV world as well as the region’s newest player – Thailand’s Loox TV, which launched on 14 November 2017 as part of satellite operator Thaicom’s effort to stir up life outside of traditional satellite services. Our count included 115 country-specific platforms and 20 platforms that serve multiple markets around the region.

The countries included are Cambodia, China, Hong Kong, India, Indonesia, Japan, Korea, Laos, Malaysia, Mongolia, Myanmar, Pakistan, Philippines, Singapore, Taiwan, Thailand and Vietnam.

Roll-out strategies vary from the Netflix-style global switch-on in January 2016 with both direct-to-consumer and partnership options, to the big-brand country-by-country launches in partnership with telcos and traditional pay-TV providers chosen by FOX Networks Group for FOX+ and HBO Asia for HBO Go.

Many of the global/regional platforms layer customisation in both line-up and language for their priority markets.

India tops our list, with 20 platforms, the biggest of them from domestic operators driven by local titles, premium slates of international content, and a month price tag of about US$3. The country’s streaming frenzy, underpinned by forecasts of a market worth upwards of US$270 million, is further fuelled by Amazon, which in Asia has prioritised India and Japan with everything from a stand-up comedy slate with India’s OML (Only Much Louder) to Alankrita Shrivastava’s feminist drama Lipstick Under My Burkha, and by Netflix, which is also hoovering up ideas and people to make them happen. On a smaller scale, regional platform Viu has also ramped up Indian originals.

Everywhere, streaming platforms are venturing into original production, from Vietnam, where BHD is making a local version of Glee for its streaming platform Danet, to Singapore, where Toggle is planning 30+ originals next year.

Outside of North Korea, the only countries with no home-grown streaming platforms ...

By mid-November, we had 135 active streaming services in 17 countries in Asia on our radar. These include big brand players we’ve known and loved from the traditional TV world as well as the region’s newest player – Thailand’s Loox TV, which launched on 14 November 2017 as part of satellite operator Thaicom’s effort to stir up life outside of traditional satellite services. Our count included 115 country-specific platforms and 20 platforms that serve multiple markets around the region.

The countries included are Cambodia, China, Hong Kong, India, Indonesia, Japan, Korea, Laos, Malaysia, Mongolia, Myanmar, Pakistan, Philippines, Singapore, Taiwan, Thailand and Vietnam.

Roll-out strategies vary from the Netflix-style global switch-on in January 2016 with both direct-to-consumer and partnership options, to the big-brand country-by-country launches in partnership with telcos and traditional pay-TV providers chosen by FOX Networks Group for FOX+ and HBO Asia for HBO Go.

Many of the global/regional platforms layer customisation in both line-up and language for their priority markets.

India tops our list, with 20 platforms, the biggest of them from domestic operators driven by local titles, premium slates of international content, and a month price tag of about US$3. The country’s streaming frenzy, underpinned by forecasts of a market worth upwards of US$270 million, is further fuelled by Amazon, which in Asia has prioritised India and Japan with everything from a stand-up comedy slate with India’s OML (Only Much Louder) to Alankrita Shrivastava’s feminist drama Lipstick Under My Burkha, and by Netflix, which is also hoovering up ideas and people to make them happen. On a smaller scale, regional platform Viu has also ramped up Indian originals.

Everywhere, streaming platforms are venturing into original production, from Vietnam, where BHD is making a local version of Glee for its streaming platform Danet, to Singapore, where Toggle is planning 30+ originals next year.

Outside of North Korea, the only countries with no home-grown streaming platforms are Laos and Myanmar. In Myanmar, the frontrunner is iflix, which has an office in Yangon and rolled out in March this year as the country’s first SVOD platform with a monthly rate of MMK3,000/US$2.

ContentAsia’s full list of streaming platforms appears in The Big List directory, published in January 2018. Edited listings from Cambodia, Japan, Mongolia and Pakistan arein Issue Seven of ContentAsia magazine in print+online.