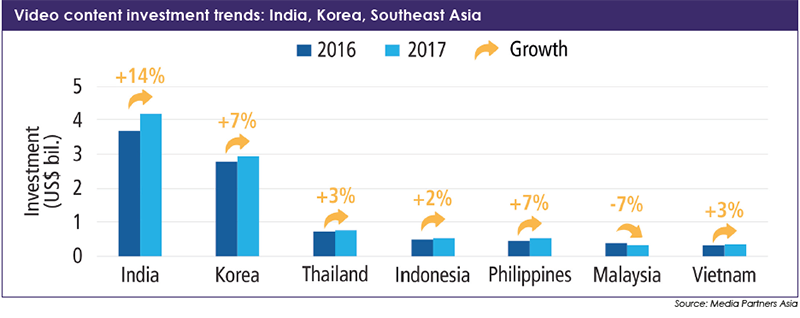

India and Korea topped Asia’s list of content big spenders in the year to end December 2017, driving the largest investment increases in seven major markets, according to Media Partners Asia’s (MPA) latest content study, Asia Video Content Dynamics 2018.

TV, movie and online video spend across the seven markets (India, Korea, Indonesia, Malaysia, Philippines, Thailand, Vietnam) reached US$10.2 billion in 2017 – an 8% increase over the previous year, the 2018 edition of Asia Video Content Dynamics says.

“In general, content investment dynamics are favorable with content investment growing,” says MPA vice president, Stephen Laslocky.

The growth laggard is Malaysia, where content spend is dropping. MPA attributes this to pay-TV platform Astro’s cuts on international pay channels. Dips in free-to-air advertising also impacted broadcaster Media Prima’s content investment.

MPA is, nevertheless, optimistic. “The outlook for Malaysia could improve as new government policies bolster economic growth, broadening consumer spend and ad dollars,” the report says.

Although from a low base, online video soaked up 30% share of incremental spend across markets. Overall, online video investment last year was up almost 80% – the highest increase of all content segments.

Still, the biggest contributor to aggregate incremental growth in video content spend last year was pay-TV, which contributed 38%.

India spent more than ever on television, movies and online video, increasing investment by 14% last year to US$4.2 billion. The stand-out increase was driven by pay-TV, with online growing rapidly because of fierce competition. MPA expects the trend to continue over the next three years.

Korea was second to India last year, with content spend up 7% last year to almost US$3 billion.

Growth will “likely accelerate” when China eventually lifts its ban on Korean dramas, movies and talent, MPA says, adding that online video content investment in Korea will continue to accelerate over the course of 2018-19.

Pay-TV content costs in the surveyed m...

India and Korea topped Asia’s list of content big spenders in the year to end December 2017, driving the largest investment increases in seven major markets, according to Media Partners Asia’s (MPA) latest content study, Asia Video Content Dynamics 2018.

TV, movie and online video spend across the seven markets (India, Korea, Indonesia, Malaysia, Philippines, Thailand, Vietnam) reached US$10.2 billion in 2017 – an 8% increase over the previous year, the 2018 edition of Asia Video Content Dynamics says.

“In general, content investment dynamics are favorable with content investment growing,” says MPA vice president, Stephen Laslocky.

The growth laggard is Malaysia, where content spend is dropping. MPA attributes this to pay-TV platform Astro’s cuts on international pay channels. Dips in free-to-air advertising also impacted broadcaster Media Prima’s content investment.

MPA is, nevertheless, optimistic. “The outlook for Malaysia could improve as new government policies bolster economic growth, broadening consumer spend and ad dollars,” the report says.

Although from a low base, online video soaked up 30% share of incremental spend across markets. Overall, online video investment last year was up almost 80% – the highest increase of all content segments.

Still, the biggest contributor to aggregate incremental growth in video content spend last year was pay-TV, which contributed 38%.

India spent more than ever on television, movies and online video, increasing investment by 14% last year to US$4.2 billion. The stand-out increase was driven by pay-TV, with online growing rapidly because of fierce competition. MPA expects the trend to continue over the next three years.

Korea was second to India last year, with content spend up 7% last year to almost US$3 billion.

Growth will “likely accelerate” when China eventually lifts its ban on Korean dramas, movies and talent, MPA says, adding that online video content investment in Korea will continue to accelerate over the course of 2018-19.

Pay-TV content costs in the surveyed markets grew 5%, led by India and Korea and driven by local entertainment and sports. Free-to-air content investment was up 6%, and film production budgets increased 10%, also driven by India and Korea.

Laslocky says scale and growth in free-to-air content investment last year is largely attributable to Korea, the Philippines, Thailand and Indonesia, and driven by local entertainment.

Online is a growing force. “Rising competitive intensity is driving up online video content costs as rival platforms produce and acquire local series and movies, especially in India and Korea,” Laslocky says, adding that he expects “online video content investment to also pick up in emerging markets across Southeast Asia, led by Indonesia and the Philippines”.

The report says growth in production spend across emerging Southeast Asia markets “was generally satisfactory in 2017”.

While free-to-air TV dominates video content investment, the pace of growth slowed substantially in Indonesia, Thailand and Vietnam due to a deceleration and broader volatility in TV advertising, Laslocky adds.

Drama drives audience share region-wide, with a fair degree of cross-pollination across markets, the report says, adding that sports also rates highly across the region.

Cricket matches, for instance, accounted for 24 of India’s 25 top-rated pay-TV programmes in 2017. In Indonesia, football matches accounted for 14 of the top 25 shows. Even in markets such as Vietnam, where sports accounted for a mere 2% audience share, football matches made up four of the top 15 programmes in 2017.

Published on ContentAsia Issue Four 2018, 24 August 2018